Beanstock supports you in all stages of your rental investment project.

How to calculate your borrowing capacity?

Before buying a property, one question always arises: how much can I actually borrow?

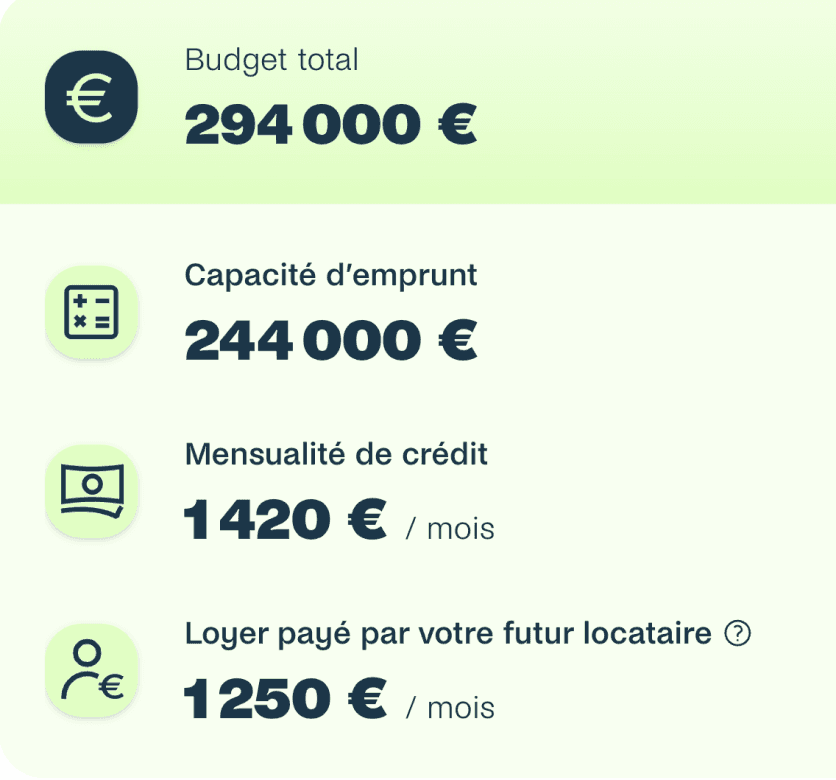

The answer lies in one key concept: borrowing capacity. It determines the maximum amount that banks will agree to lend you, and therefore the exact budget for your real estate project.

Understanding and calculating your borrowing capacity is essential to avoid unpleasant surprises: searching for an apartment out of budget, being denied a loan, or conversely underestimating your purchasing potential. This calculation depends not only on your income but also on your expenses, your debt ratio, the loan duration, additional costs, and even how the bank assesses your profile.

The income to be considered

The income taken into account by banks to calculate your borrowing capacity

Loan institutions rely on your stable and regular income to assess your creditworthiness. Generally included are:

your net salaries (excluding exceptional bonuses),

your existing rental income, often weighted at 70% or 80% to anticipate potential vacancies and management fees,

your financial income or pensions, if they are recurring and justified.

In the context of a rental investment, banks may also take into account a portion of expected future rents. Again, they generally apply a reduction of 20% to 30% to remain cautious. This allows investors not to have their borrowing capacity entirely blocked by the new mortgage, as the property generates income itself.

On the other hand, one-time bonuses, exceptional bonuses, or irregular income (micro-enterprise, freelancing without a solid history) are rarely included in the calculation, as they are considered too uncertain.

The monthly charges that reduce your borrowing potential

Unlike income, the bank will examine your financial charges, that is, all regular expenses that are already weighing on your budget. They are essential because they directly reduce your borrowing capacity.

Among these charges, we find:

The monthly payments of ongoing loans: mortgage, car loan, student loan, consumer credit…

The alimony or compensatory payments that you pay each month.

The contractual commitments such as a car leasing, a revolving credit, or any other financing subscription.

The recurring bank overdrafts or declared personal debts.

These charges are considered non-negotiable obligations, as you cannot escape them. Current expenses (rent, energy bills, food, leisure) are not included in the debt ratio calculation, but they indirectly impact the remaining living expenses criterion.

In summary, the higher your financial charges, the lower your borrowing capacity. That’s why it is often recommended to repay or consolidate certain loans before applying for a mortgage.

The debt ratio: the 35% rule to know

The debt ratio is the cornerstone of the calculation. It corresponds to the following ratio:

Debt ratio = Financial Charges/Net Income×100

In France, the rule applied by most banks is to not exceed 35%. This means that your loan payments (including new credit) should not represent more than one-third of your income. This limit is a guideline, but some banks may accept a slightly higher rate if the remaining living expenses are deemed comfortable.

Beyond the debt ratio, financial advisors place great importance on the remaining living expenses: the amount you have left each month after paying your charges and loans.

For example, a household earning €6,000 per month with a 35% debt ratio will have remaining living expenses of about €3,900, which is comfortable. In contrast, a household earning €2,000 with the same debt ratio will have only €1,300 for all its other expenses, which will be considered more risky.

The remaining living expenses therefore allow for adjustments to the analysis beyond the simple formula and can make the difference in the acceptance of a file.

Income, charges, debt ratio, and remaining living expenses are the four pillars that determine your borrowing capacity. Mastering these criteria means knowing exactly on what basis the bank will evaluate your real estate project.

The Additional Fees That Impact Your Actual Borrowing Capacity

The personal contribution: a major asset for your file

The personal contribution corresponds to the sum you invest in the project, generally from your savings. Most banks today require a minimum of 10% of the property's price to cover additional costs (notary, file, guarantee).

The higher your contribution, the stronger your file. An investor who injects €30,000 into a €200,000 project inspires more trust than a borrower who wants to finance everything through the bank.

In practice, a good contribution can:

reduce the borrowed amount and thus the monthly payments,

open access to better interest rate conditions,

increase your chances of obtaining a quick agreement.

Borrower insurance: a sometimes underestimated cost

Often seen as a detail, borrower insurance can represent up to 25% of the total cost of the loan. It covers the repayment of the loan in case of death, disability or inability to work.

For example, for a loan of €220,000 over 20 years with an insurance rate of 0.30%, this represents about €55 per month, or €13,200 over the entire duration of the loan.

Banks systematically include this insurance monthly payment in the calculation of your capacity. A poor anticipation can therefore reduce your purchase budget by several thousand euros.

Tip: comparing insurances (delegation of insurance vs bank insurance) can sometimes save several tens of euros per month and increase borrowing capacity.

File fees, guarantees, and notary: their impact on your financing

In addition, there are other unavoidable fees:

Bank file fees (between €500 and €1,500 depending on the institutions),

Guarantee fees (surety or mortgage), often 1 to 2% of the borrowed amount,

The notary fees (7 to 8% in the old market, 2 to 3% in the new market).

On a project of €200,000 in the old market, the notary fees alone amount to around €16,000. If you do not finance them through your contribution, they reduce the capacity that the bank can grant you.

Your gross borrowing capacity is just a starting point. Contribution, insurance, guarantee fees, and notary redefine the reality of the available budget. Anticipating these costs is avoiding aiming for an unaffordable property and presenting a stronger file to the bank.

Do you still have questions regarding the calculation method? Our experts are here to answer you.